A must have investment research service for ENERGY and VALUE investors.

HFI Research premium is a subscription-based service launched by HFIR to keep subscribers updated on the next big contrarian bet. Our motto is - "finding clarity in a world of uncertainty."

Our current focus is on oil and natural gas, and our stock idea generation is mainly in this area. We strongly believe that we are now finally exiting the bear cycle in the energy sector and there are many multi-bagger opportunities on the horizon. We've discussed several of them in public such as Meg Energy (MEGEF), Baytex (BTEGF), Suncor (SU), and Cenovus (CVE), but if you would like a more in-depth analysis for other energy stock ideas, then come give us a try!

We also provide real-time trading alerts on both oil and natural gas in the short term helping investors navigate the volatility of both commodities.

What do you get with HFI Research Premium?

Current reports include:

Oil Market Fundamentals (OMF)

Our oil market reports help you distinguish between what's signal and noise. It helps energy investors navigate the treacherous terrain.

Natural Gas Fundamentals (NGF)

Our natural gas market report details, fundamentals, weather, and the incoming trade set-up. We help readers in figuring out when is a good time to be invested.

Energy Idea Write-ups (IDEA)

Subscribers will receive exclusive idea write-ups twice a week. Names that we have already covered are:

Cenovus Energy

Logan Energy

Diamondback Energy

Headwater Exploration

Marathon Oil

Tamarack Valley

Athabasca

Strathcona

Greenfire Resources

Obsidian Energy

International Petroleum Corp

Canadian Natural Resources

Rubellite Energy

Whitecap Resources

Suncor Energy

Baytex Energy

Crescent Point Energy

Surge Energy

Cardinal Energy

Transocean

Spartan Delta

We plan to cover the entire energy sector by the middle of this year!

Real-Time Trade Notifications

Real-time buy and sell alerts on various energy names.

Weekly EIA Crude Storage Forecasts

Every Friday, we give the EIA crude storage estimate for the incoming week's report.

Weekly US Oil Production Forecasts

A weekly tracker for real-time US oil production so subscribers can understand what's happening to US shale growth.

What Changed This Week

Our flagship weekly report.

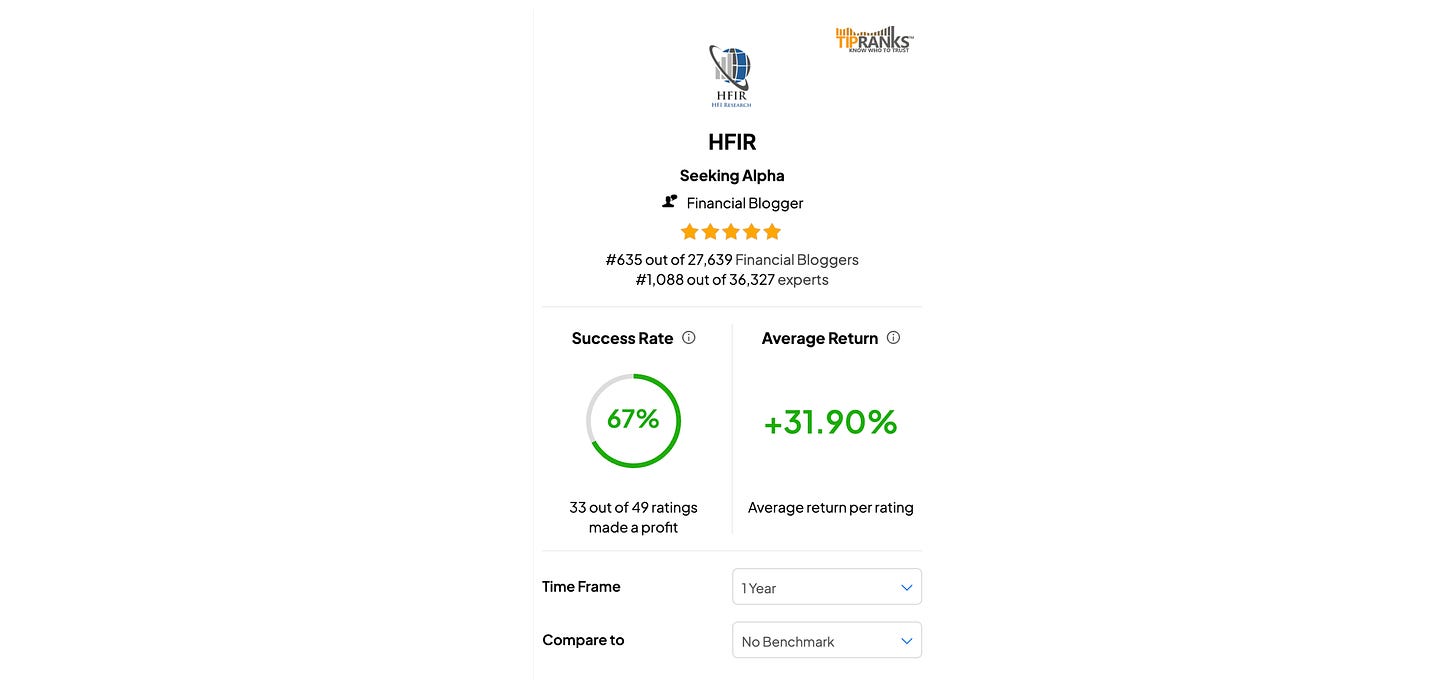

TipRanks Profile

According to TipRanks, HFI Research is #635 out of 27,639 bloggers. For some of our past top picks, please see here.

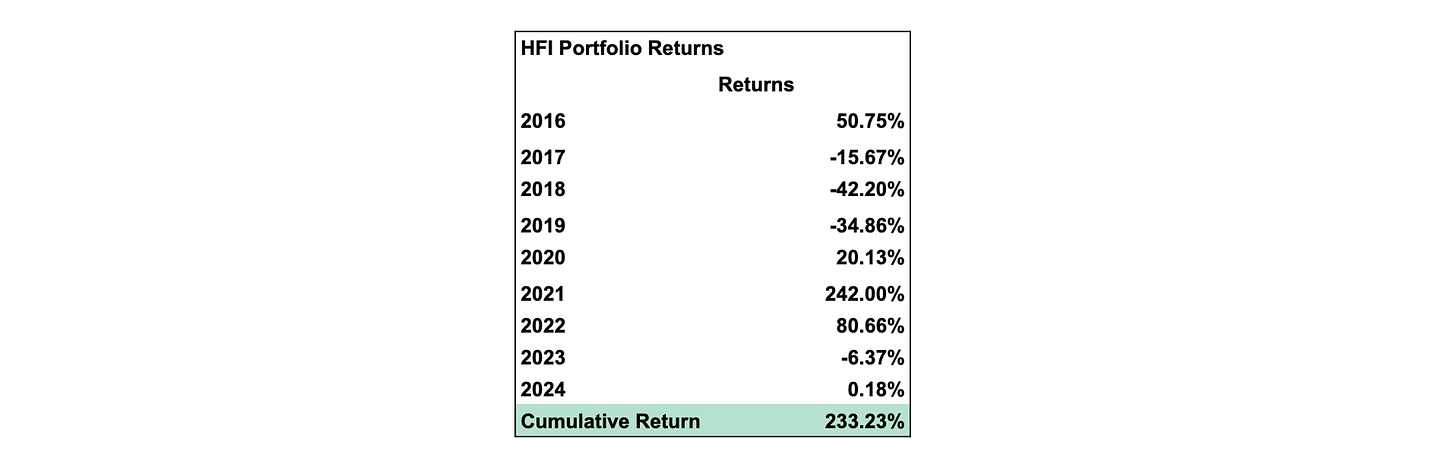

HFI Portfolio

As a subscriber, you will also receive frequent updates on what we are doing with our positions. This is how the HFI Portfolio has performed since we started investing in energy.

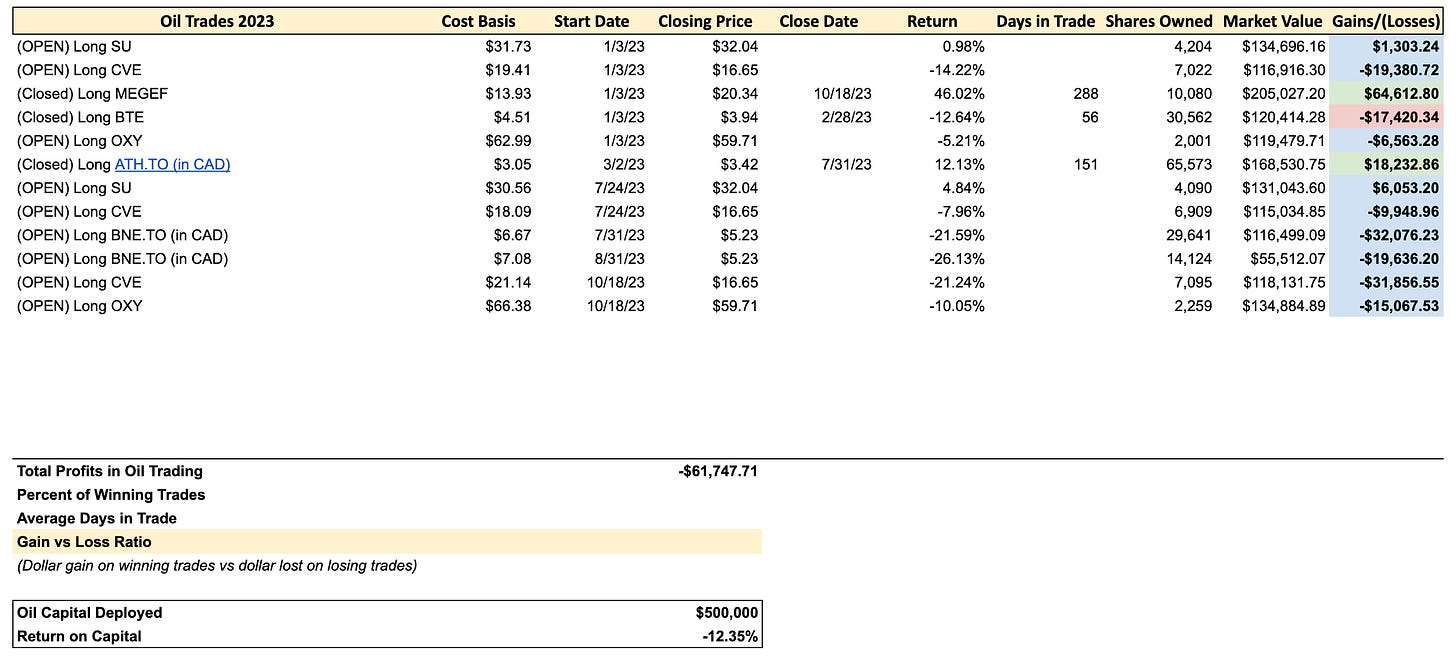

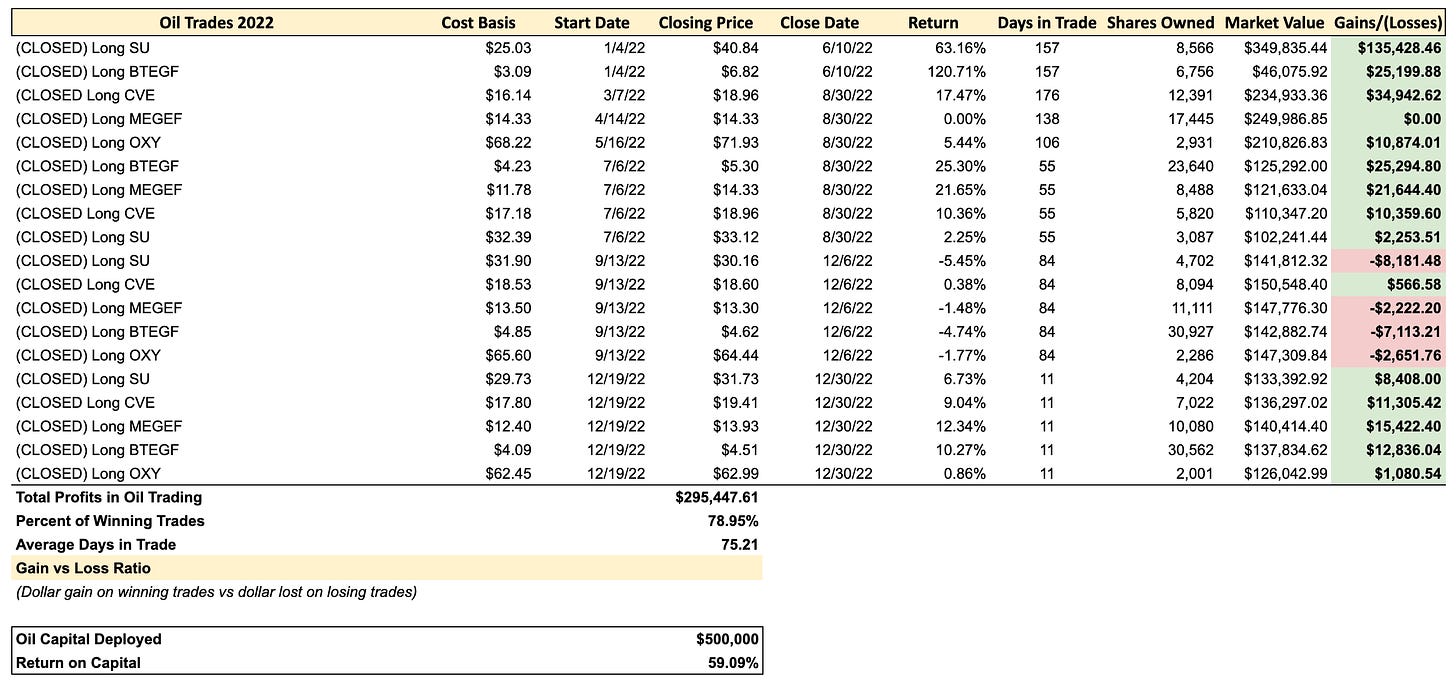

Oil Trading Portfolio Track Record

The Oil Market Fundamental report delves into what we currently see in the oil market. Based on our analysis of the current fundamentals, we issue real-time trade alerts. The following table shows all of the trades that we did from 2019 to 2021 (year-to-date).

Trading ideas could include individual stock names to oil ETFs.

2023: -12.35%.

2022: +59.09%.

2021: +99.69%

2020: +58.19%

2019: +59.40%

For detailed trade breakdowns, please direct message us.

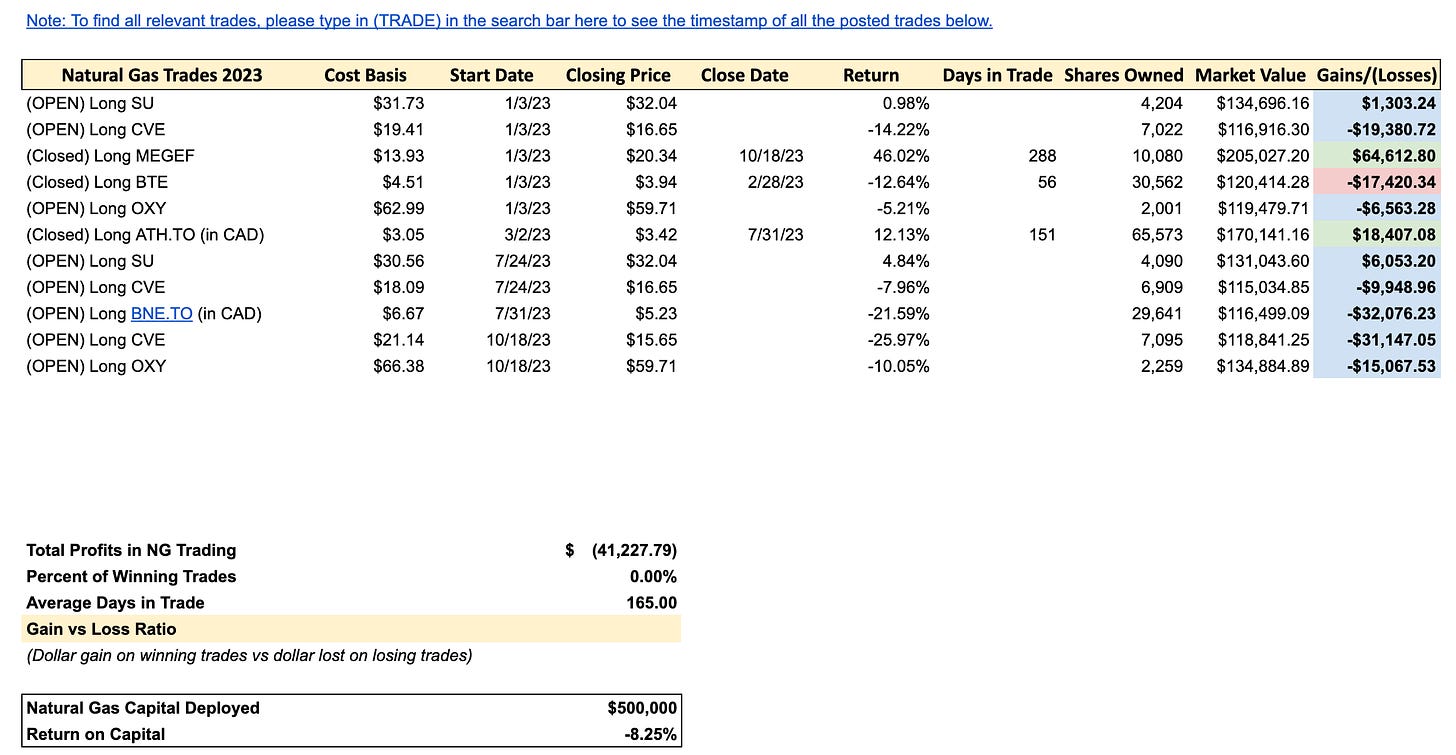

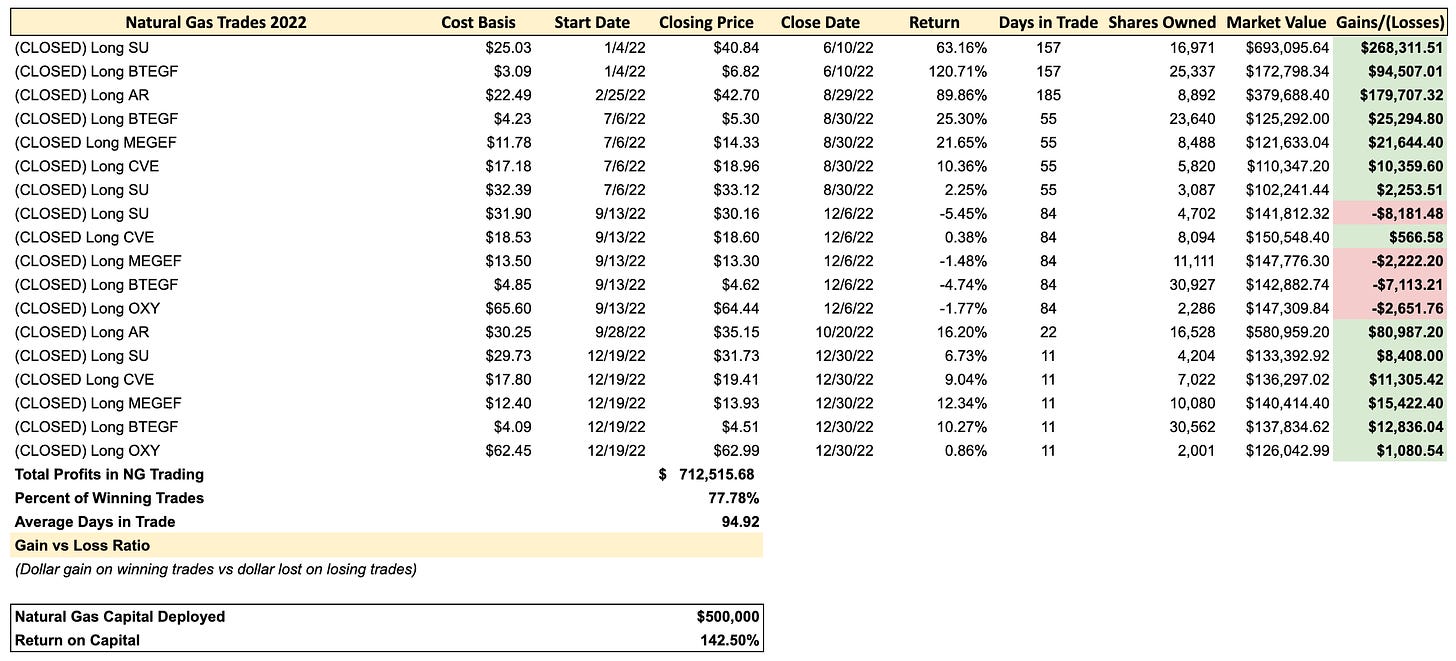

Natural Gas Trading Portfolio

Every day, we publish a natural gas report that focuses on short-term trading opportunities. These reports include a detailed analysis of natural gas supplies and demand (weather included).

Here's our trading performance.

2023: -8.25%.

2022: +142.5%.

2021: +87.78%

2020: +0.19%

2019: +13.38%

2018: +56.47%

For detailed trade breakdowns, please direct message us.

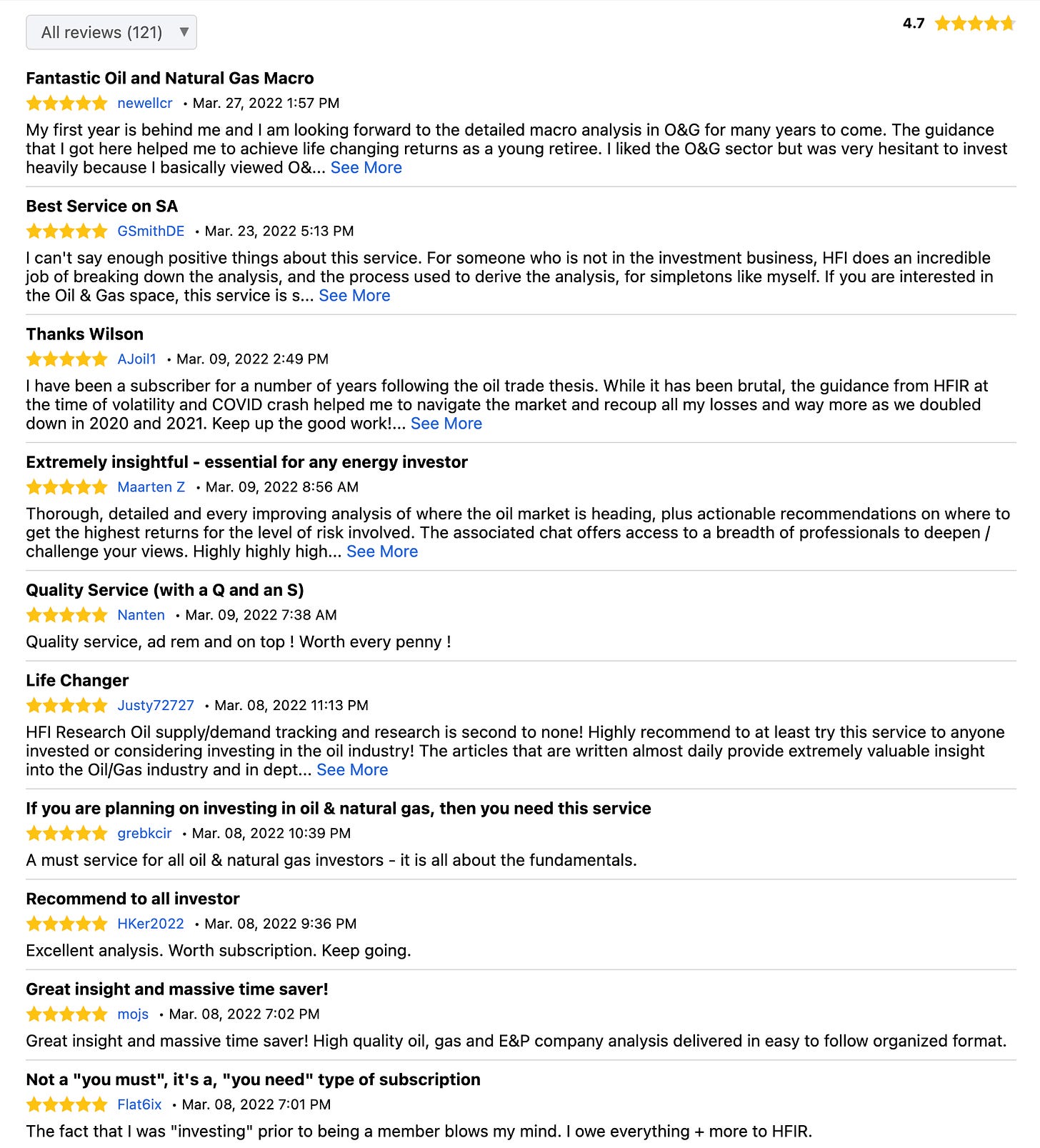

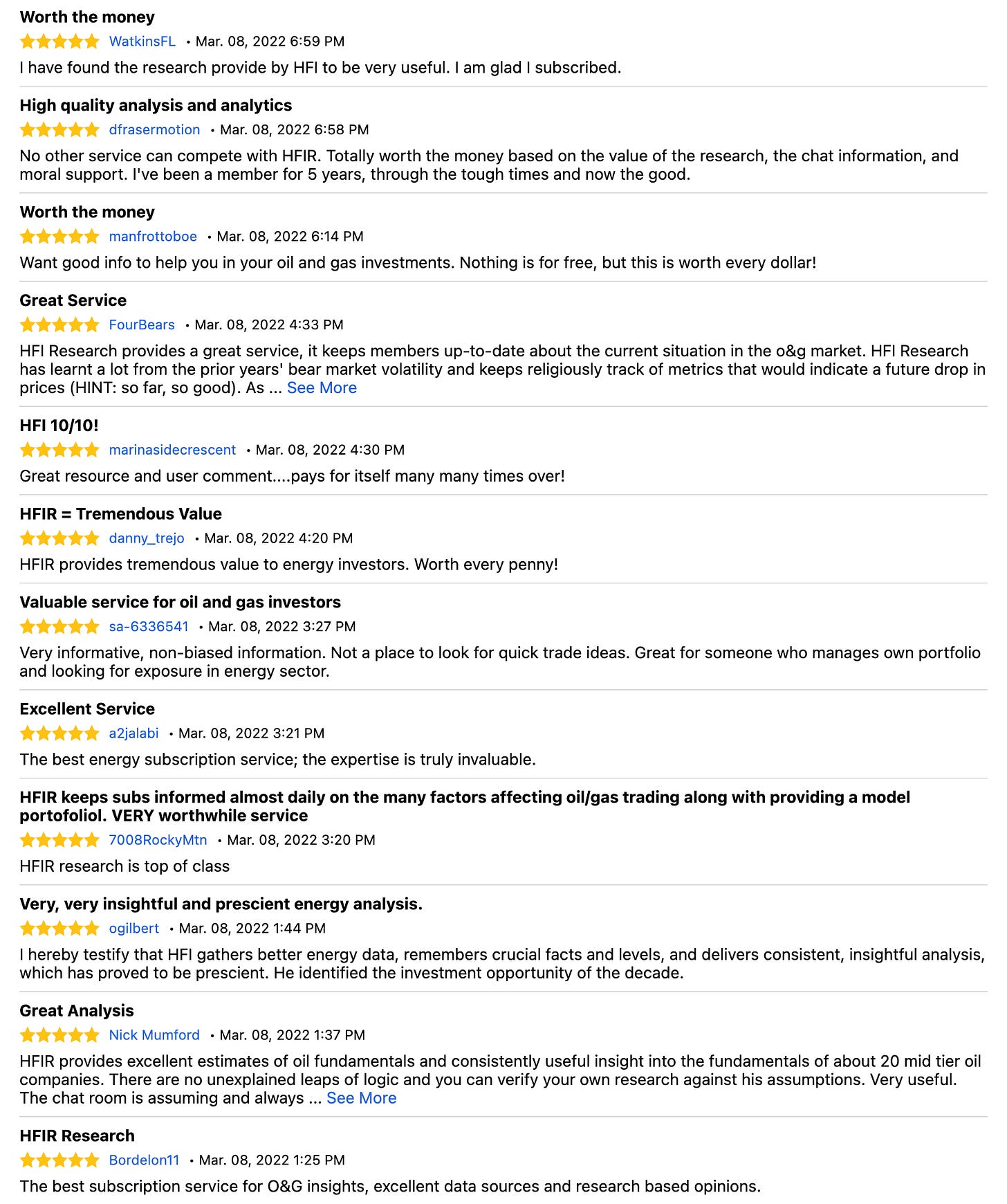

Reviews

We hope to see you join the HFI Research community!